|

|

|

|

|

||||||||

|

|

||||||||||||

|

|

UNIT

9 :

MATHEMATICS OF INVESTMENT

LESSON 4:

PRESENT VALUE ANNUITY HOMEWORK QUESTIONS

PAGE 1

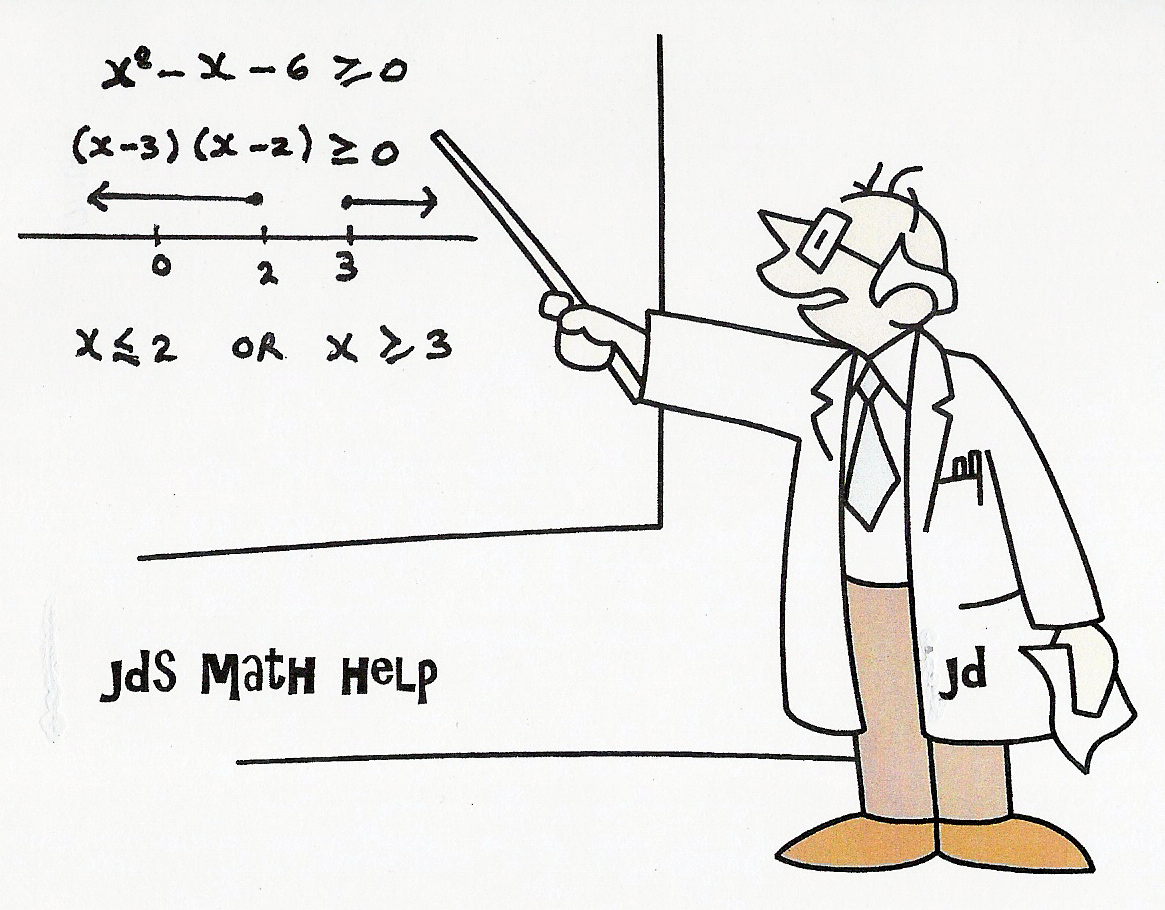

Quick Review

Present

Value of an Annuity:

Definition 1: A sequence of payments made at regular

intervals is called an annuity.

Definition 2: When we calculate the present values of the

sequence of payments made at regular intervals this is called the Present

Value of the annuity.

When a lump sum of money is deposited or borrowed today

in order to receive a series of payments in the future, this is a PV annuity

A Present Value annuity has the following properties.

![Text Box: P = principal [amount borrowed

or invested]

n = number of interest periods

i = interest rate per interest period as

as a decimal

A = accumulated amount (due or payable)](./pvannhw_files/image005.gif)

Homework Questions: (Solutions below)

1. Evaluate each of the following annuities

using the geometric series formula.

Remember to write the series backwards – last term first.

Include a complete time line diagram for

# a).

a)

![]()

![]()

![]()

![]()

![]()

![]()

![]() Interest Period 0 1 2 3 23 24 25 years

Interest Period 0 1 2 3 23 24 25 years

![]()

Payment 500 500

500 500 500

Rate of

interest is 6.65%/a, compounded annually

b)

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]() Interest Period 0 1 2 23 24 years

Interest Period 0 1 2 23 24 years

![]()

Payment 250 250 250 250 250 250 250

Rate of

interest is 6.6%/a, compounded

semi-annually

c)

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]() Interest Period 0 1 2

. . . 6 7

years

Interest Period 0 1 2

. . . 6 7

years

![]()

Payment 800 800

800 800 800 800 800

800 800 800 800 800

800

Rate of

interest is 8.4%/a, compounded quarterly

2. Evaluate each of the following annuities

using the PV annuity formula above.

Include a complete time line diagram for each.

a) 150(1.06)-12 + 150(1.06)-11

+ . . . + 150(1.06)-2 + 150(1.06)-1

b) 300(1.045)-19 + 300(1.045)-18

+ . . . + 300(1.045)-2 + 300(1.045)-1

![]()

3. Find the present value of each of the

following annuities. The interest rate

is 4.8%/a, compounded monthly. The

first payment will be at the end of the first month.

a) $500 per month for 48 months.

b) $750 per month for 12 ½ years.

c) $250 per month for 20 ¼ years.

4. Find the present value of each of the

following annuities. The interest rate

is 5.4%/a, compounded quarterly. The

first payment will be at the end of the first 3 month period.

a) $1000

every 3 months for 10 years.

b) $1500 every ¼ year for 15 ½ years.

c) $800 every ¼ year for 20 years.

5. The Witmer foundation wishes to establish an

academic athletic scholarship to be awarded each year for 25 years. The scholarship will be worth $1500 per

year. How much should be deposited now

in a trust fund that pays 6.5%/a, compounded annually?

6. Mr. I. M. Generus donated $100 000 to minor

hockey in his home town. It is to be

paid out over a 10 year period starting one year from now. How much will be paid out each year if

interest is 5.4%/a, compounded annually?

7. Betty won $2 000 000 in a recent

lottery. If she uses the funds to

purchase an annuity over 35 years, what monthly payment will she receive if interest

is 6%/a, compounded monthly?

8. Mrs. Peres purchased a car for $19 900

including all taxes. She wishes to

finance the purchase over 5 years. If

interest is 9.6%/a, compounded monthly, what will her monthly payment be?

9. Find the purchase price of an annuity that

pays $4000 every 6 months for 15 years if interest is 6.6%/a, compounded

semi-annually.

10. Mr. Cameron purchased a new tractor for his

farm for $80 000. He paid $5000 down

and financed the rest over 10 years at 10.2%/a, compounded monthly. Determine

his monthly payment and the finance charge.

Solutions:

1. Evaluate each of the following annuities

using the geometric series formula.

Remember to write the series backwards – last term first.

Include a complete time line diagram for

# a).

a)

![]()

![]()

![]()

![]()

![]()

![]()

![]() Interest Period 0 1 2 3 23 24 25

Interest Period 0 1 2 3 23 24 25

![]()

Payment 500 500

500 500 500

Rate of

interest is 6.65%/a, compounded annually

Solution:

We

calculate the present values of the 25 future payments of $500 each. Notice the

arrows go to the left for a present value annuity.

![]()

![]()

![]()

![]()

![]()

![]()

![]() Interest Period 0 1 2 3 23 24 25

Interest Period 0 1 2 3 23 24 25

![]()

![]()

![]()

![]()

![]() Payment

500 500 500 500 500

Payment

500 500 500 500 500

![]()

![]()

![]() 500(1.0665)-1

500(1.0665)-1

500(1.0665)-2

.

.

![]() 500(1.0665)-23

500(1.0665)-23

![]() 500(1.0665)-24

500(1.0665)-24

![]() 500(1.0665)-25

500(1.0665)-25

This

forms the following geometric series:

Note – write the last term first.

500(1.0665)-25

+ 500(1.0665)-24 + . . . +

500(1.0665)-2 + 500(1.0665)-1

Alternate Solution:

b)

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]() Interest Period 0 1 2 23 24 years

Interest Period 0 1 2 23 24 years

![]()

Payment 250 250 250

250 250 250 250

Rate of

interest is 6.6%/a, compounded

semi-annually

Solution:

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]() Interest Period 0 1 2 23 24 years

Interest Period 0 1 2 23 24 years

![]()

![]()

![]()

![]()

![]() Payment( 1000’s) 250

250 250 250 250 250 250

Payment( 1000’s) 250

250 250 250 250 250 250

![]()

![]()

![]() 250(1.033)-1

250(1.033)-1

250(1.033)-2

.

.

![]() 250(1.033)-46

250(1.033)-46

![]() 250(1.033)-47

250(1.033)-47

![]() 250(1.033)-48

250(1.033)-48

This

forms the following geometric series:

Note – write the last term first.

250(1.0033)-48

+ 250(1.0033)-47 + . . . +

250(1.0033)-2 + 250(1.0033)-1

c)

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]() Interest Period 0 1 2

. . . 6

7 years

Interest Period 0 1 2

. . . 6

7 years

![]()

Payment 800 800

800 800 800 800 800

800 800 800 800 800

800

Rate of

interest is 8.4%/a, compounded quarterly

Solution:

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]() Interest Period 0 1 6 7 years

Interest Period 0 1 6 7 years

![]()

![]()

![]()

![]()

![]() Payment( 1000’s) 800 800 800

800 800 800 800 800

800

Payment( 1000’s) 800 800 800

800 800 800 800 800

800

![]()

![]()

![]() 800(1.021)-1

800(1.021)-1

800(1.021)-2

.

.

![]() 800(1.021)-26

800(1.021)-26

![]() 800(1.021)-27

800(1.021)-27

![]() 800(1.021)-28

800(1.021)-28

This

forms the following geometric series:

Note – write the last term first.

800(1.021)-28

+ 800(1.021)-27 + . . . +

800(1.021)-2 + 800(1.021)-1

2. Evaluate each of the following annuities

using the PV annuity formula above.

Include a complete time line diagram for each.

a) 150(1.06)-12 + 150(1.06)-11

+ . . . + 150(1.06)-2 + 150(1.06)-1

Solution:

![]()

![]()

![]()

![]()

![]()

![]()

![]() Interest Period 0 1 2 3 10 11 12

Interest Period 0 1 2 3 10 11 12

![]()

![]()

![]()

![]()

![]() Payment

150 150 150 150 150

Payment

150 150 150 150 150

![]()

![]()

![]() 150(1.06)-1

150(1.06)-1

150(1.06)-2

.

.

![]() 150(1.06)-10

150(1.06)-10

![]() 150(1.06)-11

150(1.06)-11

![]() 150(1.06)-12

150(1.06)-12

b) 300(1.045)-19 + 300(1.045)-18

+ . . . + 300(1.045)-2 + 300(1.045)-1

Solution:

![]()

![]()

![]()

![]()

![]()

![]()

![]() Interest Period 0 1 2 3 17 18 19

Interest Period 0 1 2 3 17 18 19

![]()

![]()

![]()

![]()

![]() Payment 300 300

300 300 300

Payment 300 300

300 300 300

![]()

![]()

![]() 300(1.045)-1

300(1.045)-1

300(1.045)-2

.

.

![]() 300(1.045)-17

300(1.045)-17

![]() 300(1.045)-18

300(1.045)-18

![]() 300(1.045)-19

300(1.045)-19

![]()

Solution:

![]()

![]()

![]()

![]()

![]()

![]()

![]() Interest Period 0 1 2 3 27 28 29

Interest Period 0 1 2 3 27 28 29

![]()

![]()

![]()

![]()

![]() Payment

200 200 200 200 200

Payment

200 200 200 200 200

![]()

![]()

![]() 200(1.07)-1

200(1.07)-1

200(1.07)-2

.

.

![]() 200(1.07)-27

200(1.07)-27

![]() 200(1.07)-28

200(1.07)-28

![]() 200(1.07)-29

200(1.07)-29

3. Find the present value of each of the

following annuities. The interest rate

is 4.8%/a, compounded monthly. The

first payment will be at the end of the first month.

a) $500 per month for 48 months.

Solution:

![]()

![]()

![]()

![]()

![]()

![]()

![]() Interest Period 0 1 2 3 46 47 48

Interest Period 0 1 2 3 46 47 48

![]()

![]()

![]()

![]()

![]() Payment

500 500 500 500 500

Payment

500 500 500 500 500

![]()

![]()

![]() 500(1.004)-1

500(1.004)-1

500(1.004)-2

.

.

![]() 500(1.004)-46

500(1.004)-46

![]() 500(1.004)-47

500(1.004)-47

![]() 500(1.004)-48

500(1.004)-48

b) $750 per month for 12 ½ years.

Solution:

![]()

![]()

![]()

![]()

![]()

![]()

![]() Interest Period 0 1 2 3 148 149 150

Interest Period 0 1 2 3 148 149 150

![]()

![]()

![]()

![]()

![]() Payment( 1000’s) 750 750 750 750 750

Payment( 1000’s) 750 750 750 750 750

![]()

![]()

![]() 750(1.004)-1

750(1.004)-1

750(1.004)-2

.

.

![]() 750(1.004)-148

750(1.004)-148

![]() 750(1.004)-149

750(1.004)-149

![]() 750(1.004)-150

750(1.004)-150

c) $250 per month for 20 ¼ years.

Solution:

![]()

![]()

![]()

![]()

![]()

![]()

![]() Interest Period 0 1 2 3 241 242 243

Interest Period 0 1 2 3 241 242 243

![]()

![]()

![]()

![]()

![]() Payment 250

250 250 250 250

Payment 250

250 250 250 250

![]()

![]()

![]() 250(1.004)-1

250(1.004)-1

250(1.004)-2

.

.

![]() 250(1.004)-241

250(1.004)-241

![]() 250(1.004)-242

250(1.004)-242

![]() 250(1.004)-243

250(1.004)-243

4. Find the present value of each of the

following annuities. The interest rate

is 5.4%/a, compounded quarterly. The

first payment will be at the end of the first 3 month period.

a) $1000

every 3 months for 10 years.

Solution:

![]()

![]()

![]()

![]()

![]()

![]()

![]() Interest Period 0 1 2 3 38 39 40

Interest Period 0 1 2 3 38 39 40

![]()

![]()

![]()

![]()

![]() Payment

1000 1000 1000 1000 1000

Payment

1000 1000 1000 1000 1000

![]()

![]()

![]() 1000(1.0135)-1

1000(1.0135)-1

1000(1.0135)-2

.

.

![]() 1000(1.0135)-38

1000(1.0135)-38

![]() 1000(1.0135)-39

1000(1.0135)-39

![]() 1000(1.0135)-40

1000(1.0135)-40

b) $1500 every ¼ year for 15 ½ years.

Solution:

![]()

![]()

![]()

![]()

![]()

![]()

![]() Interest Period 0 1 2 3 60 61 62

Interest Period 0 1 2 3 60 61 62

![]()

![]()

![]()

![]()

![]() Payment

1500 1500 1500 1500 1500

Payment

1500 1500 1500 1500 1500

![]()

![]()

![]() 1500(1.0135)-1

1500(1.0135)-1

1500(1.0135)-2

.

.

![]() 1500(1.0135)-60

1500(1.0135)-60

![]() 1500(1.0135)-61

1500(1.0135)-61

![]() 1500(1.0135)-62

1500(1.0135)-62

c) $800 every ¼ year for 20 years.

Solution:

![]()

![]()

![]()

![]()

![]()

![]()

![]() Interest Period 0 1 2 3 78 79 80

Interest Period 0 1 2 3 78 79 80

![]()

![]()

![]()

![]()

![]() Payment

800 800 800 800 800

Payment

800 800 800 800 800

![]()

![]()

![]() 800(1.0135)-1

800(1.0135)-1

800(1.0135)-2

.

.

![]() 800(1.0135)-78

800(1.0135)-78

![]() 800(1.0135)-79

800(1.0135)-79

![]() 800(1.0135)-80

800(1.0135)-80