|

|

|

|

|

||||||||

|

|

||||||||||||

|

|

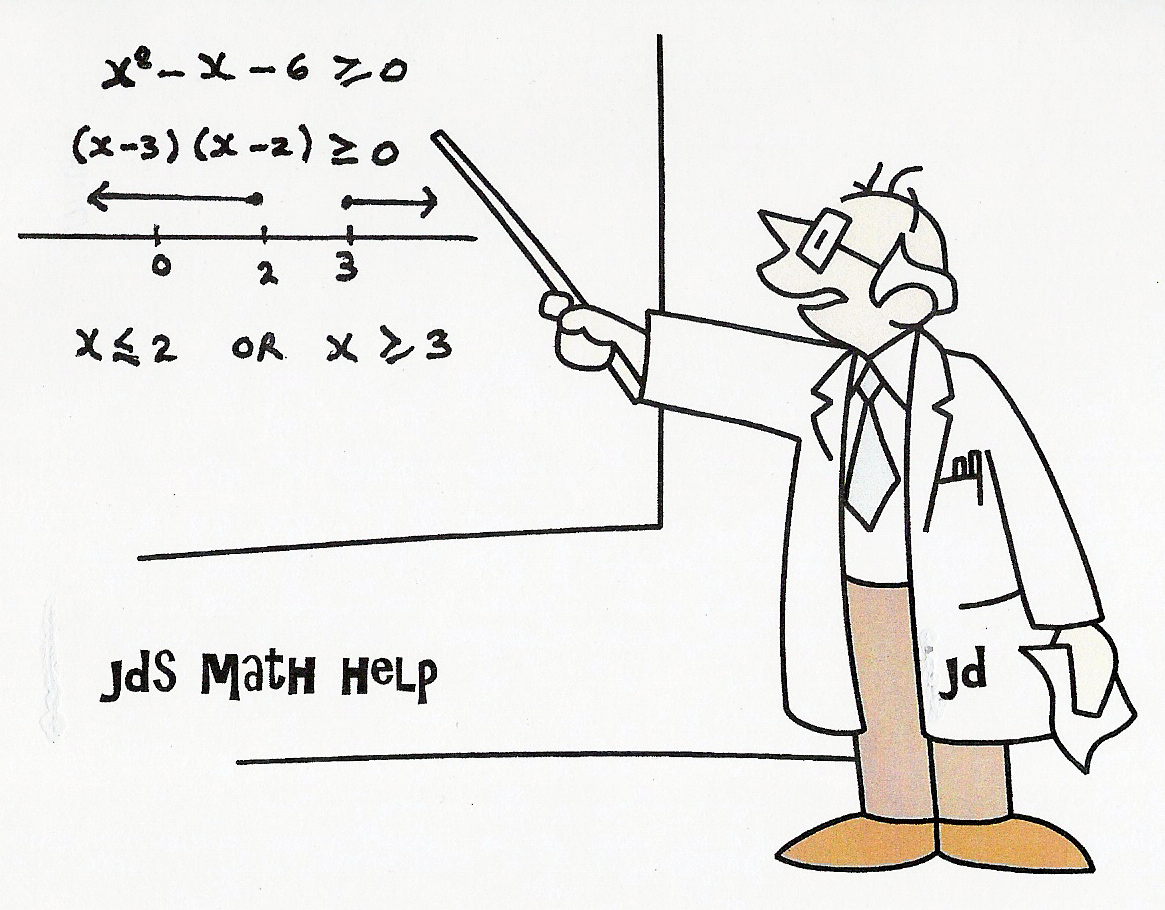

UNIT

9 :

MATHEMATICS OF INVESTMENT

LESSON 7:

UNIT 9 SUMMARY

Simple

Interest:

When you

borrow or invest money, interest is paid or earned. If the interest is calculated only on the money originally invested, it is called simple

interest.

![Text Box: I = interest due or earned

p = principal [amount borrowed

or invested]

t = time in years

r = yearly interest rate as a decimal

A = amount repayable or accumulated](./invrev_files/image002.gif)

Compound

Interest:

If

interest is calculated at the end of each year (or interest period) and added

on at this point, then this is called compound

interest.

![Text Box: P = principal [amount borrowed

or invested]

n = number of interest periods

i = interest rate per interest period as

as a decimal

A = accumulated amount (due or payable)](./invrev_files/image004.gif)

Time

Value of Money:

The

investment above can be illustrated on a time line. Time = 0 means today. The

arrow moving to the right shows the investment increasing over the 3 year

period.

![]()

![]()

![]()

![]() 0 1 2 3

0 1 2 3

![]()

![]()

![]() $5000 $5000(1.05)3

$5000 $5000(1.05)3

Note: We can evaluate a give sum of money at any point using a

time line simply using the compound interest formula, the correct interest rate

and the correct number of time periods.

Example : Using different compounding periods.

a) Shelby invested $8 000 in a 5-year term

deposit which pays interest at a rate of 5 %/a [per annum], compounded

semi-annually. What will the investment

be worth at the end of the 5 year period?

Solution:

Because

the interest is compounded every 6 months, we must adjust both the number of

interest periods n and the interest rate i.

If

interest is paid twice a year, then the number of interest periods [compounding

periods] will be 5 x 2 = 10. Hence n

= 10.

The

appropriate time line is shown below.

Since there are 10 interest periods, we will put a mark every 6 months

over the 5-year period.

0 1 2 . .

. . . 4

5

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]() …

…

![]() $8000 $8000(1.025)10

$8000 $8000(1.025)10

Present

Value:

Example:

Mr. And

Mrs. Trinh would like to have $500 000 available when they retire in 20

years. How much should they invest now

if interest is 6%/a, compounded semi-annually?

Solution:

The

appropriate time line is shown below.

Since there are 40 interest periods, we will put a mark every 6 months

over the 20-year period.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]() 0 1 2 3

4 . .

. 38

39 40

0 1 2 3

4 . .

. 38

39 40

![]()

![]()

![]() 500000(1.03)-40 500000

500000(1.03)-40 500000

They

should invest $153 278.42 today to achieve their goal.

Ordinary

Annuities:

Definition: A sequence

of payments made at

regular intervals is called an annuity.

![]()

![]()

![]()

![]()

![]()

![]()

![]() Interest Period 0

1 2 3 18

19 20

Interest Period 0

1 2 3 18

19 20

![]()

Payment 200 200 200 200 200 200

An ordinary annuity has the following properties.

![Text Box: P = principal [amount borrowed

or invested]

n = number of interest periods

i = interest rate per interest period as

as a decimal

A = accumulated amount (due or payable)](./invrev_files/image050.gif)

Example:

For the

past 5 years Amane has been depositing $100 every month into an investment

account . If the interest rate is

5.4%/a, compounded monthly, how much has she accumulated at the time of her last

deposit? Include a time line diagram in

your solution.

Solution:

$100 at

the end of every month for 5 years with interest at 4.25%/a, compounded

monthly.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]() Interest period0 1

2 . . . 238 239

240 Accumulated value

Interest period0 1

2 . . . 238 239

240 Accumulated value

Payment 100 100 100 100 100

![]()

![]()

![]()

![]()

![]()

![]() 100

100

![]() 100(1.0045)1

100(1.0045)1

![]() 100(1.0045)2

100(1.0045)2

.

.

.

![]() 100(1.0045)59

100(1.0045)59

![]() 100(1.0045)59

100(1.0045)59

Example:

Find the

annual payment for an annuity of 10 years duration at a rate of 5.6%/a,

compounded annually, that will amount to $10 000 at the time of the last

payment.

Solution:

Let the

yearly payment be $R, with the first payment at the end of the first year; i

= 0.056 and 1 + i = 1.056

![]()

![]()

![]()

![]()

![]()

![]()

![]() Interest period0 1

2 . . . 8

9 10 Accumulated value

Interest period0 1

2 . . . 8

9 10 Accumulated value

Payment R R

R R R

![]()

![]()

![]()

![]()

![]()

![]() R

R

![]() R(1.056)1

R(1.056)1

![]() R(1.056)2

R(1.056)2

.

.

.

![]() R(1.056)8

R(1.056)8

![]() R(1.056)9

R(1.056)9

Present

Value of an Annuity:

Definition 1: A sequence of payments made at regular

intervals is called an annuity.

Definition 2: When we calculate the present values of the

sequence of payments made at regular intervals this is called the Present

Value of the annuity.

A Present Value annuity has the following properties.

Example 1: Finding the Present Value of an annuity.

Heywood

recently won $5 000 000 in the lottery.

He plans to purchase an annuity that will pay him $50 000 every year for

25 years and spend the rest. How much

of his winnings would he need to pay today for that annuity if

interest is 7.6%/a, compounded annually? Include the series and a time line diagram in the solution.

Solution:

We

calculate the present values of the 25 future payments of $50 000 each. Notice the

arrows go to the left for a present value annuity.

![]()

![]()

![]()

![]()

![]()

![]()

![]() Interest Period 0 1

2 3 23 24 25

Interest Period 0 1

2 3 23 24 25

![]()

![]()

![]()

![]()

![]() Payment( 1000’s) 50 50 50 50 50

Payment( 1000’s) 50 50 50 50 50

![]()

![]()

![]() 50000(1.076)-1

50000(1.076)-1

50000(1.076)-2

.

.

![]() 50000(1.076)-23

50000(1.076)-23

![]() 50000(1.076)-24

50000(1.076)-24

![]() 50000(1.076)-25

50000(1.076)-25

This

forms the following geometric series:

Note – write the last term first.

50

000(1.076)-25 + 50000(1.076)-24 + . . . + 50000(1.076)-2 +

50000(1.076)-1

Hence

Michael needs $552 492.55

of his winnings to purchase the annuity. He would have $5 000 000 - $ 552

492.55 = $4 447 507.45 left to spend.

Alternate Solution:

Notice

this present value amount is much less than the total amount paid out over 25

years which would be 25 x $50 000=$1 250 000.

General

Annuities:

Definition: An annuity where the payment intervals are not the same as the

interest intervals.

Example:

Find the

amount of an annuity of $700 every 6 months ( ˝ year ) for 12 years if interest is 6%/a, compounded monthly.

Solution:

Here the

payment interval( ˝ year ) is different

than the interest period (monthly).

This is a general annuity.

We must

match the interest period to the payment interval.

Ie. We

must find the semi-annual rate that is equivalent to 6%/a, compounded monthly.

Step 1:

Using the formula A = P(1 + i)n,

find the value of $1 invested at 6%/a, compounded monthly after 1 year.

Step 2:

Let the equivalent ˝ year rate be i %. (Note the

equivalent yearly rate would be 2i %.)

Now find the value of $1 invested at i % per ˝ year after 1 year.

A = 1(1 + i)2 ** n = 2, the number of times interest is

compounded per year.

Step 3:

These two amounts must be equal.

Hence

Now find

the amount of the annuity using the annuity formula.

![]()

![]()

![]()

![]()

![]()

![]()

![]() Interest per. 0 1 2 . . . 22

23 24 Accumulated value

Interest per. 0 1 2 . . . 22

23 24 Accumulated value

Payment 700 700 700 700 700

![]()

![]()

![]()

![]()

![]()

![]() 700

700

![]() 700(1.030377509)1

700(1.030377509)1

![]() 700(1.030377509)2

700(1.030377509)2

.

.

.

![]() 700(1.030377509)22

700(1.030377509)22

![]() 700(1.030377509)23

700(1.030377509)23

![]()

Hence the amount of the annuity is $24 212.83.

Mortgages:

Example 1:

a) Camille has just purchased a new house near

Brantford. She needs a mortgage of

$150 000 after her down payment.. She

will repay it in monthly instalments over 25 years. The interest rate is 6.6%/a, compounded semi-annually. Find the monthly payment.

b) Determine the total interest paid over the

25 year period.

Solution:

Here the

payment interval( monthly ) is different than the interest period (

semi-annual). This is a general annuity.

We must

match the interest period to the payment interval.

Ie. We

must find the monthly rate that is equivalent to 6.6%/a, compounded

semi-annually.

Step 1:

Using the formula A = P(1 + i)n,

find the value of $1 invested at 6.6%/a, compounded semi-annually after 1 year.

Step 2:

Let the equivalent monthly rate be i %. (Note the equivalent yearly rate would be 12i %.)

Now find the value of $1 invested at i % per month after 1 year.

A = 1(1 + i)12 ** n = 12, the number of times interest is

compounded per year.

Step 3:

These two amounts must be equal.

Hence

The money in question is borrowed now – at

point 0 on the time line. Hence this is

a PV general annuity question

![]()

![]()

![]()

![]()

![]()

![]()

![]() Interest Period 0 1 2 3 58 59 60

Interest Period 0 1 2 3 58 59 60

![]()

![]()

![]()

![]()

![]() Payment

R R R R R R

Payment

R R R R R R

![]()

![]() R(1.005425865)-1

R(1.005425865)-1

![]() R(1.005425865)-2

R(1.005425865)-2

.

.

R(1.005425865)-298

![]()

![]() R(1.005425865)-299

R(1.005425865)-299

![]() R(1.005425865)-300

R(1.005425865)-300

This

forms the following geometric series:

R(1.005425865)-300 +

R(1.005425865)-59 + . . . + R(1.005425865)-2 +

R(1.005425865)-1

b)

Determine the total interest paid over the 25 year period.

Total amount repaid = 1013.85 x 300

= $304 095.00

Mortgage amount = $150 000

Interest paid = $304 095 - !50

000 =$154 095

Hence

The total interest paid over 25 years is $154 095.